It was a banner year when grid-scale energy storage began to grab headlines as a number of demonstration projects moved from the drawing board to operational reality. Examples include a 20 MW frequency regulation plant that Beacon Power commissioned in Stephenstown, New York, shortly before seeking bankruptcy protection; two power reliability systems that Ener1 (HEV) agreed to supply for the 2014 Winter Olympics; projects from A123 Systems (AONE) that smooth minute-to-minute variability in the power output from wind farms; micro-grid projects from ZBB Energy (ZBB) that provide power quality, reliability and cost management benefits for remote naval bases and other facilities; and a behind-the-meter system from Axion Power International (AXPW.OB) that provides a combination of power quality, reliability and cost management benefits for Axion's New Castle plant while generating third-party revenues by providing frequency regulation services to the PJM Interconnection.

Each of these projects is an important technical milestone in its own right, but they're only the tip of the iceberg. While Lux Research forecasts that sales of grid-scale energy storage systems will reach the half-billion mark next year, the sector is expected to grow to $1.5 billion a year by 2015 and potentially represent a $200 billion revenue opportunity. The problem for investors is that inherent differences in the various grid-scale energy storage systems announced to date have led to profound confusion over the basic question of where the most attractive short-term business opportunities lie.

There are no clear answers, but there are some important landmarks to help investors get their bearings.

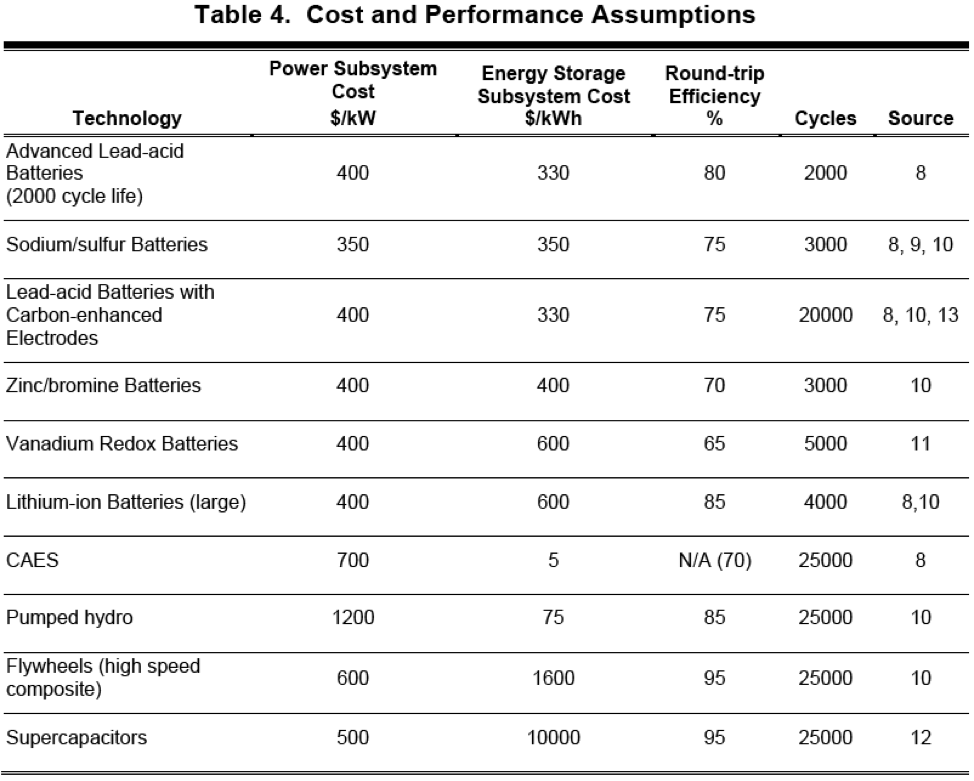

I recently stumbled across an April 2011 report from Sandia National Laboratories titled "Energy Storage Systems Cost Update" that provides useful generic guidance for investors. The first important point in the report is that every grid-scale energy storage system has two critical subsystems that ultimately dictate system cost. The first is a Power Subsystem that includes the control electronics, communications equipment, AC-DC inverters and other hardware needed to connect a battery array to the grid. The second is an Energy Storage Subsystem that includes the battery array itself. While the costs in the following table are generic estimates that won't usually be spot-on accurate, they can be helpful to investors who want to assess and understand the revenue impact of a particular facility for the battery manufacturer.

In most press releases for grid-scale energy storage installations, ratings are given for both system power (expressed in kW or MW) and system energy (expressed in kWh or MWh). For example, in late October, A123 and AES commissioned a 32 MW ? 8 MWh storage facility at a wind farm in Laurel Mountain, West Virginia. Based on the Sandia table, total system costs would include $12.8 million for the Power Control Subsystem and $4.8 million for the Energy Storage Subsystem, or roughly $17.6 million overall. Earlier this week, A123 announced that it would supply a 1 MW ? 1 MWh system for use at a utility substation in Maui. Again, based on the Sandia table, total system costs would include $0.4 million for the Power Control Subsystem and $0.6 million for the Energy Storage System, or roughly $1 million overall.

In a recent webinar titled "Grid Storage: Connecting dots in a fragmented market," Lux Research observed that while the grid-scale storage market historically focused on long duration energy projects, the trend over the next few years will be heavily weighted in favor of power projects. The reason that the distinction is critically important for investors is that power projects offer far less benefit to the battery manufacturer than energy projects. In Laurel Mountain, for example, approximately 70% of the total cost was paid to equipment vendors for the Power Subsystem and A123's share was roughly 30%. In comparison, A123's share of the Maui contract will be about 60% while equipment vendors for the Power Subsystem will garner about 40% of the revenue. The bottom line is that it's important for investors to understand the specific function an installation will serve if they want to understand the revenue and cost of goods sold impact for the battery manufacturer.

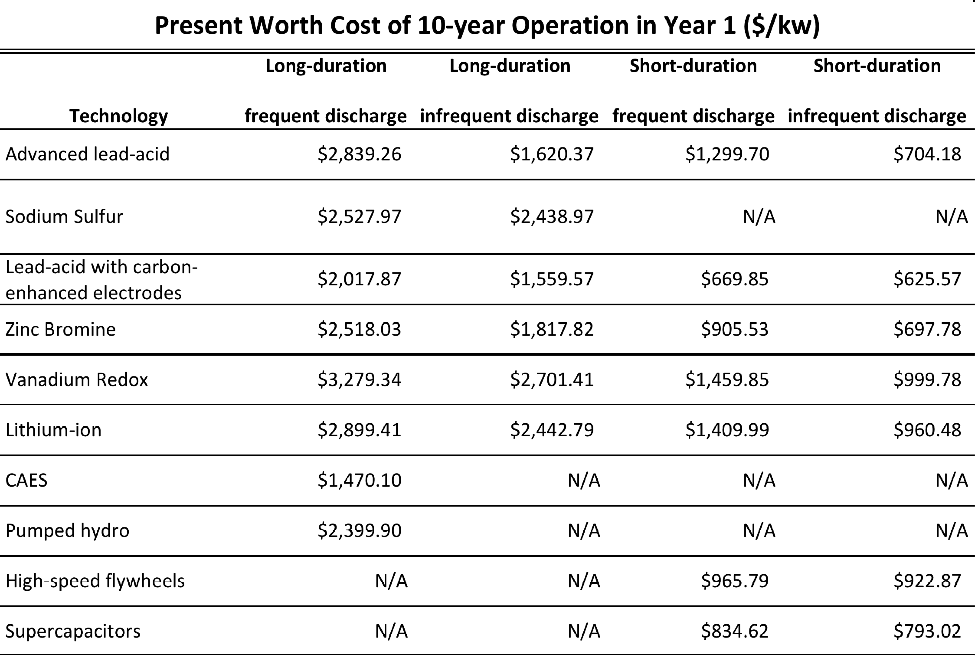

In addition to providing a reasonable basis to estimate the revenue impact of a particular installation on a battery manufacturer, the Sandia report also estimated the discounted present value of the 10-year total cost of ownership for each of the generic energy storage systems identified in the first table. The following table rearranges the total cost of ownership data from Sandia to conform to the presentation format and order used above.

The important part of the total cost of ownership table isn't so much the dollar values the Sandia model calculated for the generic energy storage systems as the fact that several technologies can be cost competitive and the buying decision will be made based on the specific performance requirements of the buyer and the specific performance capabilities of the system that's being evaluated as a potential solution. I'm a firm believer in the law of economic gravity ? that the cheapest solution for any problem will usually win the lion's share of the business. That's particularly true in applications like grid-scale energy storage where the normal size increment is a 40-foot shipping container and weights are rounded to tons. Some buyers will be subject to significant space or weight constraints, but most will not. Therefore, the critical decision metrics will be reliability, performance that matches the customer's needs and total cost of ownership.

Over the last few years a quasi-religious mythology has arisen on Wall Street about the inherent superiority of lithium-ion batteries for every application you can imagine. It's a delusion that has its source in masterful PR rather than economic reality. While there's no question that lithium-ion is and will remain the go-to battery chemistry for applications like portable electronics and electric vehicles where size and weight are mission critical constraints, size and weight are not significant advantages when it comes to grid-scale facilities.

That leads to an inescapable conclusion that manufacturers of advanced lead-acid battery systems like Enersys (ENS), advanced lead-carbon battery systems like Axion Power International, zinc bromine battery systems like ZBB Energy, lithium-ion battery systems like A123 Systems and flywheel based systems like Active Power will all be competitive in the grid-scale energy storage space and each of their technologies will have a more than ample base of potential customers.

Grid-scale energy storage is a very big tent with plenty of room for several successful competitors that can bring a cost-effective product to market and earn a share of the business. While I'm a big fan of emerging lead-carbon battery technologies because I worked for a lead-carbon battery developer when its technology was little more than a laboratory experiment, I'm the first to remind readers that there is no silver bullet and the space will be incredibly competitive for decades. The racers are a couple steps out of the starting blocks and lithium-ion presently enjoys a half-step lead. With 397 meters left to run and 10 hurdles left to clear, it's far too early for anybody to be crowning a champion.

Disclosure: Author is a former director of Axion Power International (AXPW.OB) and holds a substantial long position in its common stock.

Source: http://seekingalpha.com/article/315675-understanding-the-grid-scale-energy-storage-boom?source=feed

lance ball lance ball kansas city chiefs drew brees drew brees tom brady packers

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.